What Lies Ahead for Churches Looking for Insurance?

Over the past six months our agency has seen a massive increase in calls for insurance coverage for Churches that have had their insurance coverage cancelled. What lies ahead is unknown except many of these Churches are going to have sticker shock.

Premium increases have been affecting all lines of Property and Casualty Insurance. But Churches have been hit harder than other industries. While the following is anecdotal, these are issues we are seeing when we visit with Churches throughout Ohio.

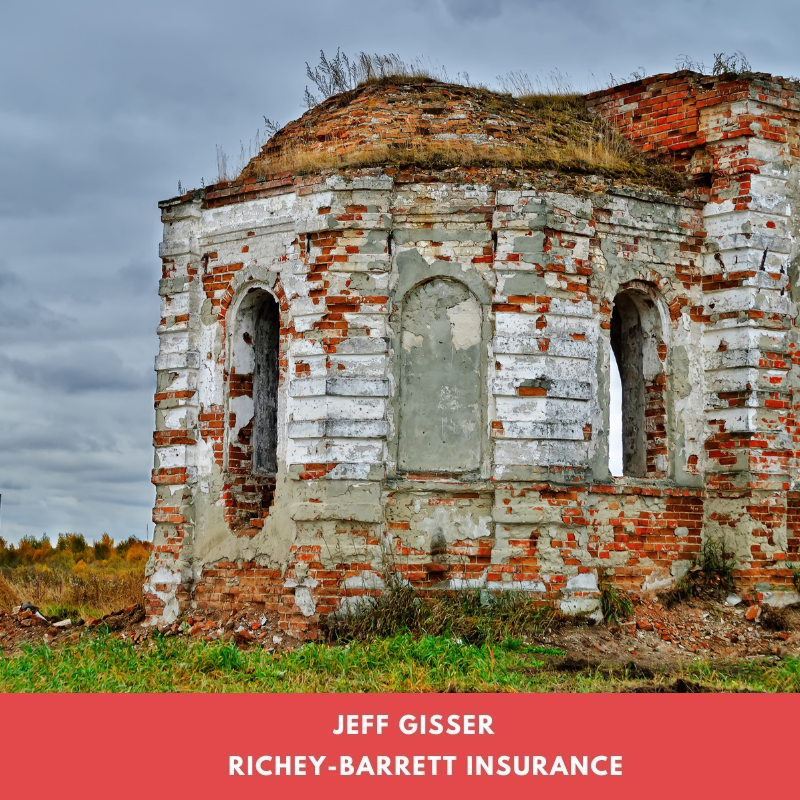

As membership and revenues have decreased in a post covid environment maintenance has been deferred. Many Churches no longer have the revenue stream to keep up their property. This deferred maintenance could mean not addressing a deteriorating roof. When you are walking the property, you may discover shingles or tiles on the ground, notice tuck pointing on the mortar and bricks that needs to be addressed to stop wind driven rain from entering and damaging the interior of the building. Or something as simple as no longer having your fire extinguishers serviced.

On the General Liability side of the reduction in membership and revenue equation – Your Church may have fewer volunteers to take on projects around the Church. Fixing handrails, changing light bulbs, shoveling and salting. The failure to take care of these little things can create hazards and ultimately an insured loss for the Church.

Dwindling revenue can also cause turn over in employees and at many Churches processes and procedures are not well documented, training is often word of mouth! This can increase the risk of loss especially when it comes to employee dishonesty and cyber-crimes.

While some Churches may feel like deferring maintenance and letting insurance take care of it is a solution to the lack of funds to maintain your building in the long run it may backfire. A quick example,

A church had deferred maintenance on the roof of their building. When a series of tornadoes swept through Northeast Ohio on August 6th 2024, damaging the already deteriorated roof of the Church. As obligated by the policy the insurer paid to repair the roof for a substantial price. The insurer then non-renewed the policy later that year. As the insurer was investigating the claim they became aware of several other deficiencies in the building. The Church then contacted us to see if we could quote their insurance. After making a site visit to the Church I discovered a new roof but so many other issues with the building that we could only provide a quote in a “non-standard” property market and the Church was unable to afford the premium.

In the above example we were unable to assist the Church but we continue to help many Churches throughout Ohio, so before you renew your policy give the Trusted Choice Agents at Richey-Barrett Insurance a call.