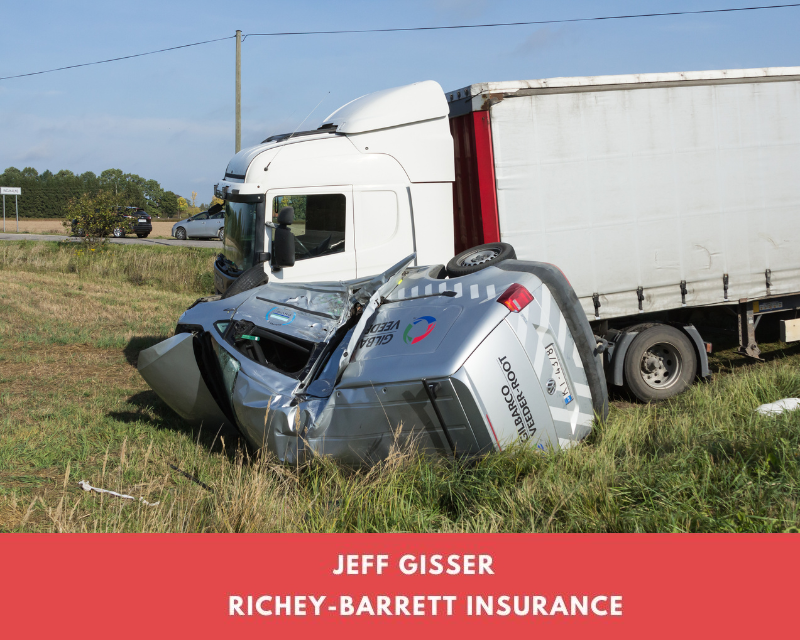

Up Up and Away-Commercial Auto Rates Are Rising

There are many reasons commercial auto rates are rising and as a business-owner you can control some of them.

- Inexperienced Drivers-A shortage of drivers caused by high demand, a retiring workforce and drivers leaving the industry. This turnover has put the industry in flux. As hiring standards are lowered more accidents are going to occur.

To mitigate the potential for loss, do your due diligence prior to hiring.

- Vehicle repair costs and replacement costs continue to outpace inflation. According to the Federal Reserve Bank of Minneapolis auto repair inflation was just over 17% in September of 2023. Labor shortages in body shops and mechanical repair shops have pushed up repair costs. Similar to truck drivers older techs are leaving the industry as technology becomes more complex in vehicles.

To offset higher repair costs consider keeping older vehicles in your fleet on the road longer and instituting a strong preventative maintenance program

- Losses caused by distracted driving. From vehicle infotainment systems to texting has led to an increase in preventable accidents. According to our partners at Travelers Insurance crashes due to mobile phone distraction that resulted in a preventable death are up 18% since pre-pandemic levels.

To stop distracted driving install systems such as Azuga or Velocitor Solutions. These systems can monitor in truck/cab activity.

Less controllable as a business-owner but pushing commercial auto insurance premiums up are;

- Bodily Injury loss costs; Losses have increased at an alarming rate. From 2018-2022 the severity of losses has increased by 40% even though the frequency of accidents has declined according to Lexis Nexis Risk Solutions. Causes for these increases include an increase in deadly accidents, rising verdicts in cases that go to trial as well as medical cost inflation. Medical inflation is expected to increase 7% in 2024.

- More claimants are being represented by attorneys. This could be the result of a variety of issues that are beyond the scope of this blog. However, when claimants are represented by attorneys claims see higher rates of expenditures for medical treatment and procedures

Insurance is complicated and the changing geography of price and capacity has accelerated the complexities! So, before you renew your Commercial Auto insurance contact the Trusted Choice Agents at Richey-Barrett Insurance.