Location. Location. Location.

Read why commercial property rates are increasing in all locations in 2020.

Learn about one, across-the-board effect of catastrophic commercial property losses.

Cleveland and Northeast Ohio are home to a wealth of commercial real estate. The gamut includes world class health care facilities; cultural institutions; theaters; research, manufacturing, and food processing operations; apartment buildings; churches; office and retail space. Every one of these “locations” is a commercial property, which in some way depends on the commercial property insurance market.

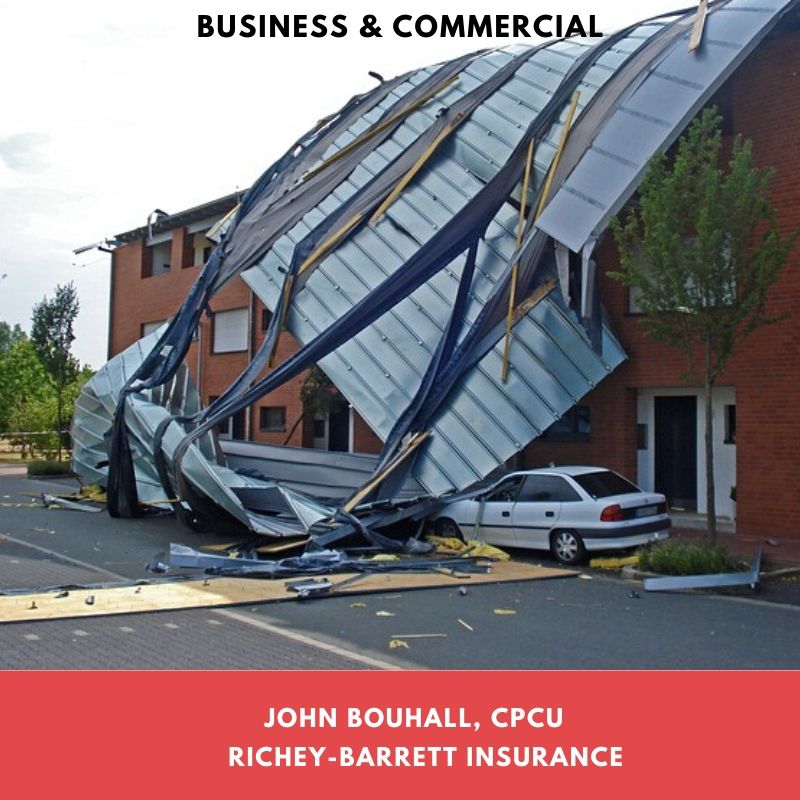

Big stuff, in the form of unprecedented, catastrophic losses, bombarded the commercial property insurance market from 2017-2019. Floods, wildfire, hail, severe storms, and tornadoes devoured premium dollars. The fallout is hitting commercial property insureds in 2020. Rate increases are across-the-board, including in Northeast Ohio.

While coastal flooding and wildfires are not associated with Northeast Ohio, severe storm and hail damage have occurred in our geographic location in recent years. Even though Ohio is not generally considered part of Tornado Alley, it did make a list in 2019 for states with the most tornadoes (see online article by Eric Elwell published 2:45 PM ET JUN 26, 2019, titled, “Ohio Reaches Top 10 For States With Most Tornadoes”). The largest rate increases apply to properties located where particular weather extremes have wreaked havoc, yet overall commercial property rates are increasing. Currently, we are seeing an average increase in commercial property rates of 7% to 10%, with some reaching 15%.

If Northeast Ohio is not a geographic location where the bulk of unprecedented, catastrophic commercial property losses have occurred, why are commercial property rates increasing here in 2020? One way to understand this is by thinking of “location” in macro terms. Consider the big-picture location for property insurance as worldwide. Relentless, widespread, catastrophic property losses are not sustainable. It stands to reason that if the losses are not sustainable, the insurance providing coverage for such losses is not sustainable. Something(s) have to give, so to speak. Rate increases are one of the most practical adjustments insurance companies may implement when losses are higher than expected.

A second and similar approach to the big-picture location perspective described above is envisioning “location” in terms of pooling. Insurance is a complex mechanism of risk pooling (grouping risks into categories, such as commercial property) and transferring that risk (in this case, to commercial property insurers) in exchange for a premium expected to be sufficient to cover the risks in the pool. If you visualize this “pool” as the “location” of unprecedented, catastrophic losses, it follows that a reasonable first measure to maintain viability of the pool is to increase rates for all pool members.

Finally, think of “location” as it usually comes to mind, i.e. the actual site of property. This aspect is important in commercial property rating from the standpoint of proximity to fire protection, crime level in the area, susceptibility to damage due to certain weather or environmental conditions. Site location(s), along with several other factors (age, square footage, type of occupancy, type of construction, condition of the property, approved safety/security devices, loss history) are used to individually underwrite each risk. As important as these factors are in underwriting individual commercial property risks, they do not alleviate the necessity for across-the-board commercial property rate increases in 2020 to shore up the market.

Your Trusted Choice Independent Insurance Agents at Richey-Barrett Insurance are proud to be located in Northeast Ohio. Our history includes 100+ continuous years of dedicated service to commercial insurance clients of varied locations, types, and sizes. Experience matters. In addition to Ohio, Richey-Barrett Insurance is licensed in other states.