Cover Your Condo and Contents With Proper Insurance

Learn what individual condo unit owners and renters need to know about insurance.

Read about the importance of properly insuring individual, residential condo units.

Homeowners are usually aware of and want to purchase appropriate homeowner’s insurance to protect their interests. However, where the home is a residential condominium unit, people are often confused about the distinction between property and liability insurance for the condominium association and for the condominium units. This blog is geared toward the owners and renters of individual, residential condominium units.

To begin, from a property standpoint only, understand who owns what, and who is responsible for what. In general terms, the chart below provides a visual summary of the distinction. Actuallegal documents and/or circumstances may operate to broaden or limit the basic distinctions below.*

WHO OWNS WHAT AND WHO IS RESPONSIBLE FOR WHAT*

Owner/Occupant of

Residential

Condominium Unit

Everything from the 2”X4” facing side of the drywall, i.e. all drywall/interior walls and ceilings, plumbing fixtures, light fixtures, cabinets, countertops, flooring in the individual condominium unit

Contents, such as furniture, appliances, décor, artwork, jewelry, electronic devices, tv sets

Owner/Non-occupant

of Residential

Condominium Unit

Everything from the 2”X4” facing side of the drywall, i.e. all drywall/interior walls and ceilings, plumbing fixtures, light fixtures, cabinets, countertops, flooring in the individual condominium unit

May or may not own some of the contents, such as furniture and appliances.

Non-owner/Renter

of Residential

Condominium Unit

Whatever contents are personally owned.

Residential

Condominium

Association

Building exterior.

All common areas, interior and exterior.

Contents in or on the common areas.

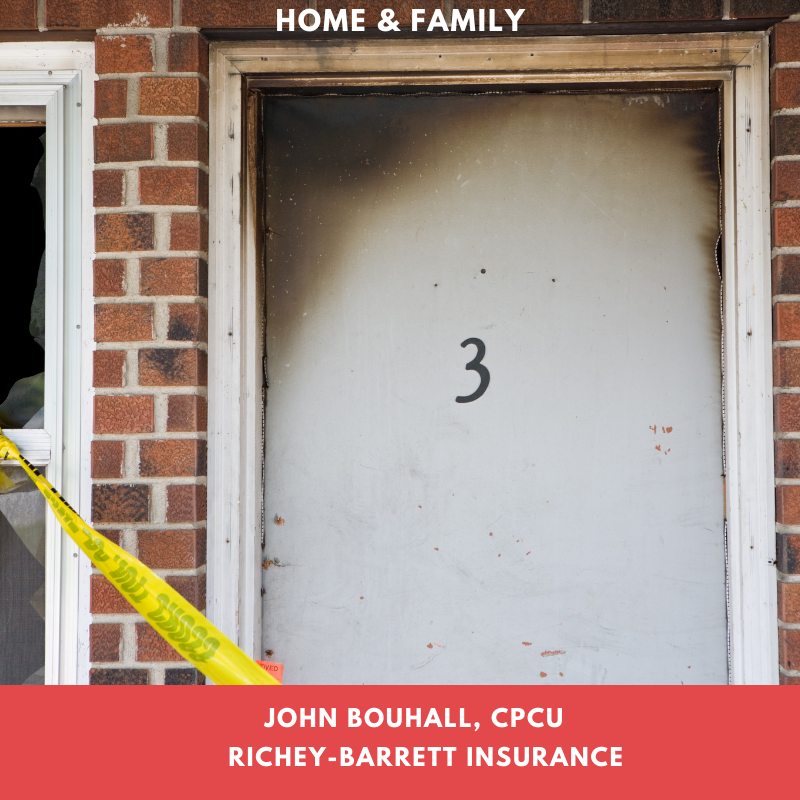

Liability insurance is just as important to maintain as property insurance. You need it whether you are the owner/occupant, owner/non-occupant, or non-owner/renter. Richey-Barrett Insurance recommends:If you own it, insure it. A few years ago, several condominium owners in a newer residential building in Olmsted Falls were literally without a roof over their heads following a total loss to the building due to an accidental fire. Those who had no insurance or inadequate insurance were left without a home, no means to replace their loss, and no insurance to cover the cost of temporary housing during the rebuild. Whatever property insurance a condominium association has on the building does not cover individual condominium units or their contents. Each unit owner is responsible for maintaining his/her own property insurance coverage. Even if you occupy the condominium unit as a non-owner/renter, remember to buy a contents policy.

– A base, minimum liability limit of $300,000. One fluke accident arising out of the use or occupancy of your condominium unit could blow through a $300,000. liability limit in no time. Your net worth should be a primary factor in considering what higher liability limit is acceptable to you.

– If owner/non-occupant is permitted to rent an individual unit, require the tenant provide proof of renter’s insurance with a minimum liability limit of $300,000. Insist on an additional interest Certificate of Insurance, which specifies the owner be notified in the event of cancellation or non-renewal.

Richey-Barrett Insurance is your Trusted Choice Independent Insurance Agent for homeowner’s insurance, condominium insurance, and renter’s insurance.