Check All Mirrors Before You Merge

Learn one area of non-profit, tax-exempt status that is often misunderstood.

Read why churches and non-profits should carefully monitor tax-exempt status.

Throughout history, churches have received the benefit of some form of tax relief. In the United States, the granting of tax exemptions to churches pre-dates the American Revolution. Today, the widely recognized tax-exempt status that applies to most churches in the United States is Section 501(c)(3) of the Internal Revenue Code.

Undoubtedly, 501(c)(3) status is key to the financial viability of many churches and non-profit organizations. However, in Ohio, Ohio law controls whether or not a church or non-profit organization qualifies for property tax exemption, not 501(c)(3) status. It is also important to recognize that the interpretation of the Ohio property tax exemption law has been litigated, and some of the results have surprisingly not favored the charitable organization.

Mirror Check:

Distinguish the difference between federal tax-exempt status and Ohio property exemption law and case law.

Mirror Check:

Is the church or non-profit organization planning a change in its legal structure or mission, or the sale or acquisition of property, that should be reviewed and discussed with qualified legal counsel before action is taken?

Mirror Check:

Is the church or non-profit organization grappling with financial challenges, and the solutions being considered may expose it to potential violations of the Ohio property tax exemption under ORC 5709.07?

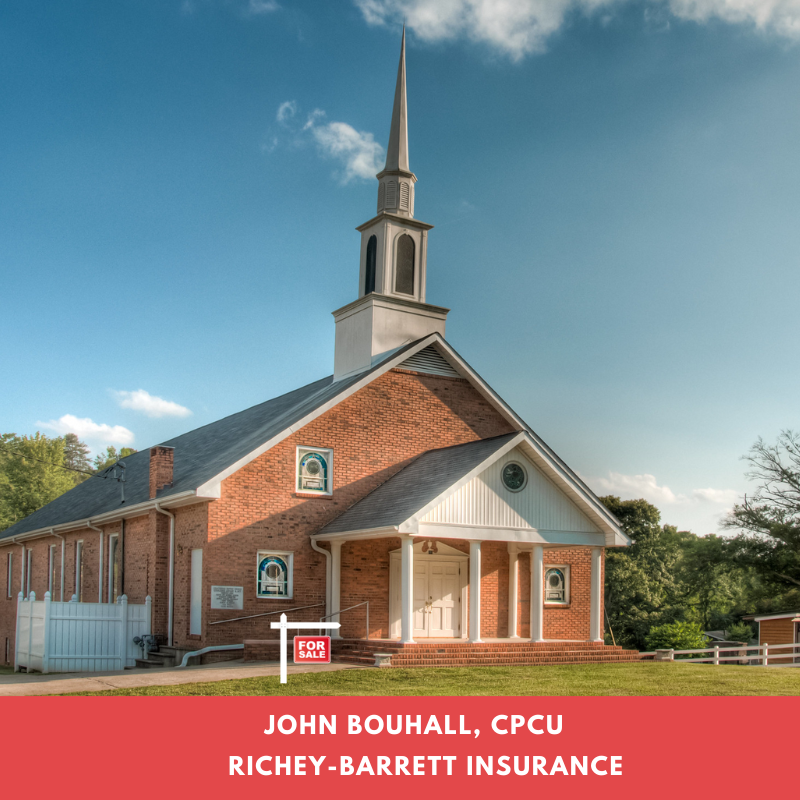

Consider the following real life example experienced by a church with respect to the issue of property tax exemption. As many churches struggling financially choose to do, this church opted for the merge lane, i.e. joining with another church in the area. The church property was put on the market for sale, but had not been sold when it was vacated. Within a year of vacating the church building, it began receiving unexpected property tax bills on the unsold, vacant church building. Through the course of prospective buyers inquiring about the church property for sale and contacting the local jurisdiction regarding land zoning, the municipality determined a vacant church no longer met the charitable use requirement. Soon the church began receiving property tax bills.

Late Mirror Check:

Use of property is one key determinant in Ohio real property tax exemption under ORC 5709.07.

For now, the situation has been resolved by the return to the vacant church building for worship services and a weekly mission project. Hopefully, a buyer will be found soon, and the church is able to conduct all worship and mission activity in the partner church’s building.

Late Mirror Check:

The timeline for a sale to begin and be finalized will likely be very impactful on the human and financial resources of the church, which ultimately affects the viability of its mission.

The contents of this blog are for educational purposes only and are not intended as professional advice.

Contact your Trusted Choice Independent Insurance Agent at Richey-Barrett Insurance to discuss your church’s insurance needs.