Building Owners Protect Your Assets

COVID-19 and Building Vacancy

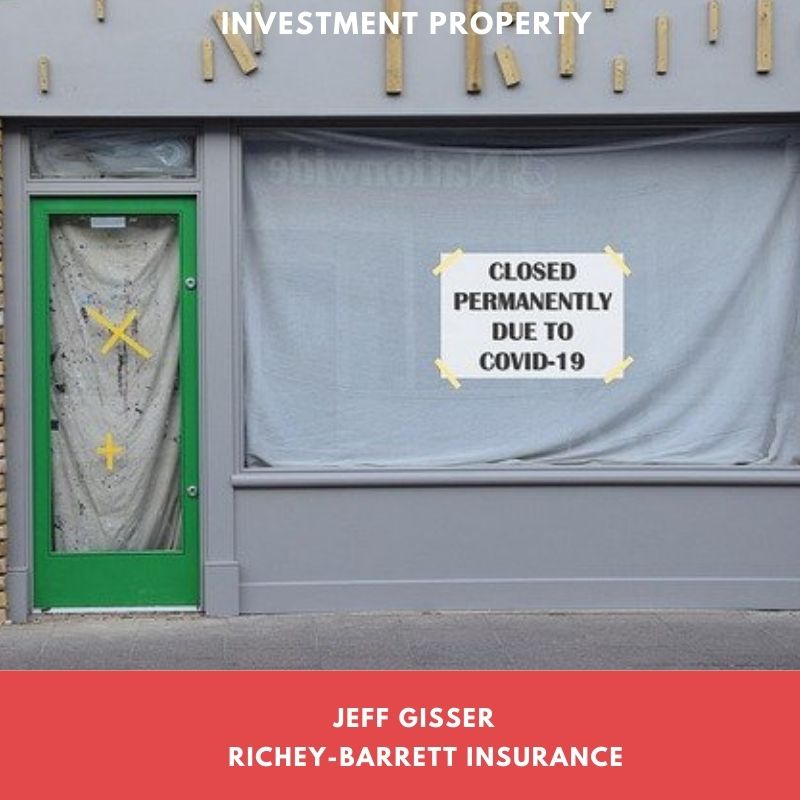

As I travel throughout Northeast Ohio, I see what COVID-19 has done to this once bustling area. Highways empty, office complexes with empty parking lots as employees work from home and shopping centers with more and more vacancies as small retailers continue to shut their doors. Once the scourge of Covid-19 is controlled, I can only hope that many of these small businesses will reopen, but many will not. Will the owners of strip shopping centers be able to find new tenants?

The standard/unendorsed property section of the Insurance Service Office businessowners policy addresses vacancy in several ways. It may limit coverage or it may give the Insurance company the right to cancel your policy.

The policy states: We may cancel this policy by mailing or delivering to the first Named Insured written notice of cancellation at least: a. Five days before the effective date of cancellation if any one of the following conditions exists at any building that is Covered Property in this policy: (1) The building has been vacant or unoccupied 60 or more consecutive days. *

Buildings with 65% or more of the rental unit or floor areas vacant or unoccupied are considered unoccupied under this provision. * An example where this could easily occur is if an anchor tenant leaves a strip center. The anchor tenant occupied 50% of the building and ceased operations. If you already had 1 or 2 units that were vacant, you could easily be over the 65% vacancy and be subject to cancellation!

The causes of loss are also amended by the vacancy clause in the policy.

As used in this Vacancy Condition, the term building and the term vacant have the meanings set forth. When this policy is issued to the owner or general lessee of a building, building means the entire building. Such building is vacant unless at least 31% of its total square footage is: Rented to a lessee or sublessee and used by the lessee or sublessee to conduct its customary operations; and/or (ii) Used by the building owner to conduct customary operations. *

If the building is considered vacant for more than 60 consecutive days, the insurance company will not pay any loss or damage caused by any of the following even if they are covered causes of loss: vandalism, sprinkler leakage (unless you have protected the system against freezing), building glass breakage, water damage, theft or attempted theft. *

The standard policy goes on to state: “With respect to Covered Causes of Loss other than those listed above, we will reduce the amount we would otherwise pay for the loss or damage by 15%. *

In reviewing these two limitations to the policy it is obvious how COVID-19 can create a large insurance gap in your program. Many insurance companies represented by Richey-Barrett have property enhancement endorsements that may lower the percent to be considered vacant to 11% thus giving building owners greater leeway in avoiding potential uninsured losses to their assets.

Before you renew your policy contact the Trusted Choice Insurance agents at Richey-Barrett so we may review your policy to ensure you are properly covered in these difficult times.

*Policy language taken and paraphrased from a standard Insurance Service Office businessowners form BP 00 03 07 13 -Policies in force at time will predicate how all losses are adjusted.