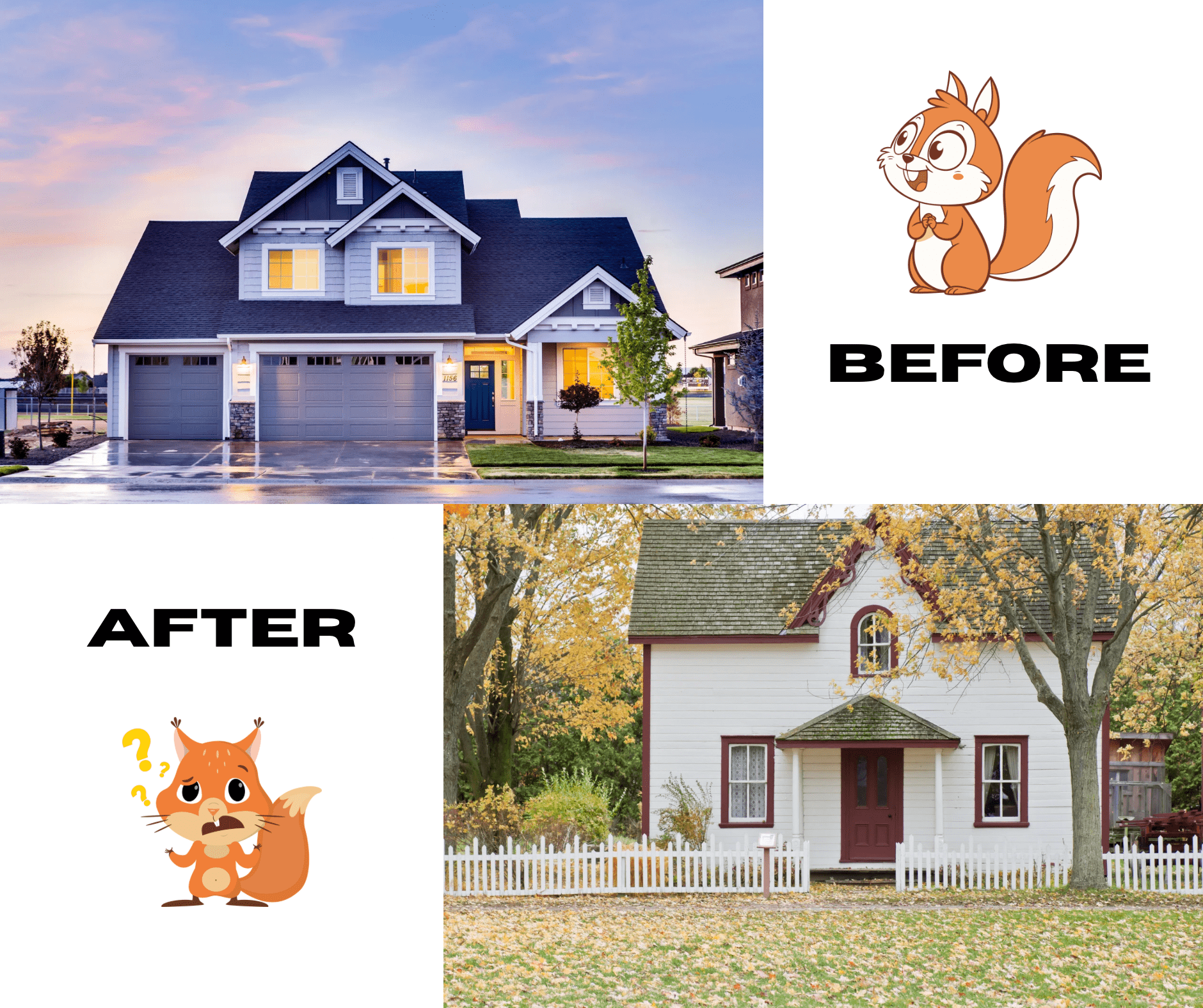

Before and After: The Cost of Underinsuring Your Home

I’m often asked how home insurance values are determined and why there is a disconnect between market value and it’s insured value.

Everyone loves the lowest price on home and auto insurance. Myself included. The ultimate goal though is to ensure that if something happens, you will be made whole again. To do this, it’s important that your insurance advisor take the additional steps to make sure the policy reflects your current situation.

Why is this important and how can we be sure we get it?

Loss of Equity

Homes are often the single largest investments families make in their lifetimes, with the majority financing their purchase. While it’s expected that over time real estate values will increase, allowing homeowners to build wealth through equity, what would happen if that expectation was stolen by an unforeseen event?

Let’s expand on that for a moment. What started as a home with fair market value of $600,000, may result in a home valued at $450,000 following a total loss. The features of the dwelling having been stripped as there was no coverage available to rebuild of like kind and quality.

How will your net worth be altered in this situation after a devasting loss?

Although cliché, when insurance agents talk about “peace of mind,” constantly, this is what we mean—not the instant gratification of keeping an extra $10-20 in your pocket each month.

Compromise on Amenities

Not only can underinsuring your home have an effect on your overall net worth, it also comes with an impact to your lifestyle. Let’s discuss the home-buying process for a second. How did it play out for you and your family?

Did you make a list of “must have’s,” and “nice-to-have’s,” when deciding which house to purchase? Would you be as happy with your home without the amenities you’ve grown accustomed to?

Without adequate protection, any effort to rebuild as it was is futile, without additional investment from you. Compromises will be made – the particulars you love about your home may be downgraded to keep costs in-line. Is that what you want from your insurance policy?

Getting a Realistic Value

We as a society are conditioned to believe getting a home insurance quote should take less than 15 minutes. In some cases, that’s true. In others, a more in-depth process is required.

To put it in perspective, not long ago, I talked with a gentleman whose home was insured for about $600,000. However, due to the updates made over time, it would cost roughly $1,037,000 to replace as-is if disaster struck.

How did we determine this number?

Reliance on the 15-minute estimate would have left this man unprotected. Instead, we had a conversation to discuss the details of his residence, generating what it might cost to replace in 2025 dollars.

The conversation took about half-hour, 45 minutes maybe, to ensure his home was adequately covered. Is it worth your half-hour to protect $400,000 of assets? Sometimes that’s what it takes.

Think about the last home insurance quote you got for a minute. Were you asked about the specifics of your home, or did they only the address, and perhaps when several updates were last completed? Were your remodeled kitchen and bathrooms discussed? How about the hardwood flooring you installed to replace carpet, or the basement you finished last year?

If the specifics of your home aren’t being discussed, you could very well end up with a policy that can’t rebuild your home following a total disaster. While the couple dollars of savings is certainly reason to be happy, think about the purpose of insurance – make you whole again following a loss.

At Richey-Barrett Insurance, we focus on providing complete and proper coverage to protect your assets and situation, while remaining within your budget. Don’t settle for less. Let’s talk about your home to determine if you have the right coverage for your needs.