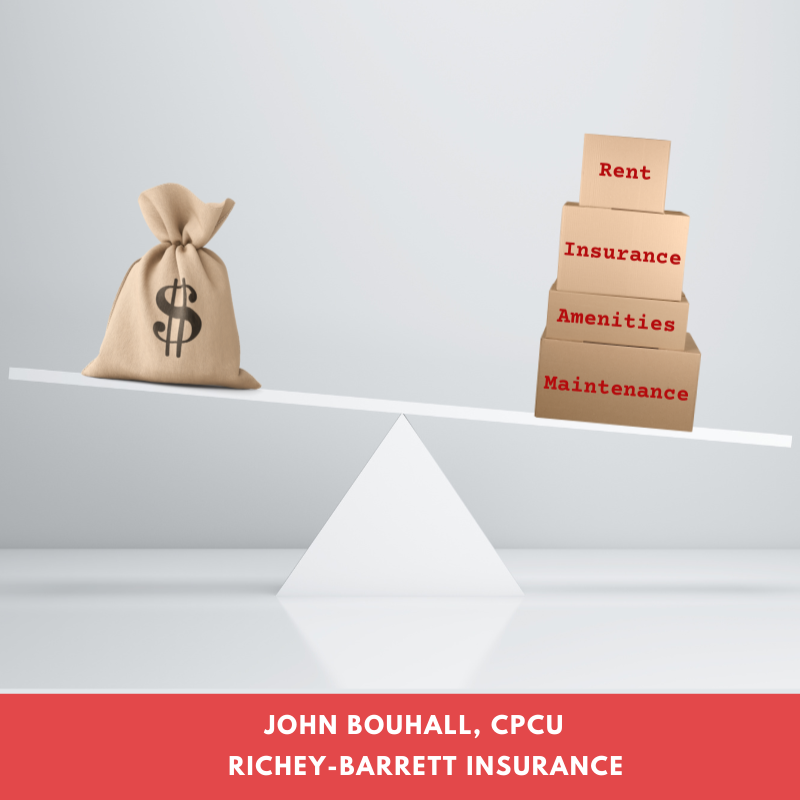

Balance Your Investment

Discover a back-to-basics approach to weigh investment property decisions.

Learn the potential benefit of visualization when investing in an investment property.

From the constant pings and beeps of our electronic devices to fingertip access to information, we can easily get lost in an always-on, out-of-control world. Going back to basics is helpful to calm our senses and reset our thoughts. It is fundamental to understand that owning investment property(ies) is a business, which requires capital outlay. That capital outlay is made with the expectation of a return in the form of income and/or profit. Unlike the old joke about a boat, an investment property is not a bottomless hole into which one pours money.

An investment property owner must consider how much money to put down up front, when to make additional improvements, as well as the ongoing business expenses associated with the investment property. From straightforward to middle-of-the-road to tough decisions, try visualizing them using the image of a basic balance weight scale. By mentally picturing “this or that” scenarios, you can meaningfully balance the weight of investing money in one area vs. investing money in another area vs. making no investment.

Visualization tends to open and focus the mind. The items listed below are suggested topics and sub-topics investment property owners may consider; they are not intended as professional advice. The idea is to imagine possible effects to your investment property business of adding and subtracting “investment” in a few key areas.

- Maintenance

- Is your investment property clean and well-maintained?

- Are necessary repairs promptly made?

- Do you thoroughly inspect units when a tenant moves out?

- Do you have a formal checklist and schedule of when units are repainted, recarpeted, appliances updated, etc.?

- Rent

- Is the rent reasonable and affordable with respect to the community in which your investment property is located?

- Is the size of your investment property conducive to offering a tenant a discount, if, for example, the tenant performs a weekly task of sweeping the entry area and steps, or ensures trash bins are properly stowed on the property?

- Amenities

- Does the scale of your investment property allow providing betterments such as on-site laundry facilities, exercise equipment, a pool, a garden and gardening tools dedicated for tenants’ use to grow their own vegetables, etc.?

- Insurance

- Is your budgeted insurance program a bare-bones package, or have you prioritized a proper insurance plan, inclusive of insuring to replacement cost value, adequate business income loss coverage, umbrella liability limits, etc.?

- Is your insurance representative accessible, knowledgeable, and responsive?

Richey-Barrett Insurance is your Trusted Choice Independent Insurance Agency for investment property insurance. We are experienced in providing quality insurance for residential and commercial investment properties. Call us today to discuss the right insurance for your investment property(ies).