1, 2, 3 Basics for Investment Property Owners of Individual Condominium Units

Learn three basic considerations for investment property owners of individual condominium units.

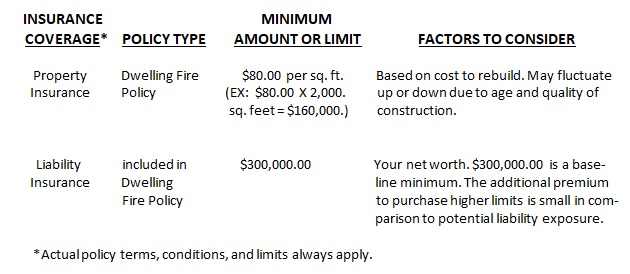

Read a snapshot of insurance coverage recommendations for condominium unit investment property.

Individual condominium unit ownership is a real thing in the realm of investment property. Some fall into it indirectly, such as via inheritance. Some directly decide to purchase a condominium unit as an investment property. How the investment property condominium is acquired is usually not as important as understanding what is acquired. Like most investments, there are pros and cons. Whether a prospective, new, or seasoned investor in condominium units, your interest or potential interest in that investment property is best protected by understanding a few basics.

First, read, read, and reread. Ohio law requires condominium owners and tenants comply with deed restrictions, declaration, bylaws and administrative rules and regulations of the condominium association. Before you invest in a condominium unit as an investment property, determine if non-owner occupancy is allowed. If not, you are legally restricted from renting any unit to anyone. Violators subject themselves to civil action, injunctive relief, and denial of insurance.

Second, responsibility follows ownership. If owners of individual condominium units are permitted to rent them, understand exactly what you own, as the investment property owner. Misunderstandings pertaining to who owns what have resulted in bad decisions about purchasing insurance and bad outcomes following severe or total losses. As a rule of thumb, always consult applicable legal deeds and documents. That said, more often than not, the condominium association is responsible for the building exterior and all common areas, interior and exterior. Each unit owner is responsible for the 2”X4” facing side of the drywall. So, the unit owners are usually responsible for all drywall/interior walls and ceilings, plumbing fixtures, cabinets, countertops, and flooring in their individual unit(s).

Third, protect your investment property by properly insuring your interest in the individual condominium unit(s) with a Dwelling Fire Policy that includes Liability coverage.* Examples of common causes of loss that a Dwelling Fire policy including Liability coverage would cover are:

– Property damage to the owned condominium unit(s) caused by accidental fire

and resulting smoke; storm damage due to windows blowing out; water damage

from a leaking toilet or overflowing sink or bathtub

– Liability protection for you, the investment owner of the condominium unit(s),

from bodily injury claims (EX: slips or trips in your unit) and property damage

claims (EX: your tenant’s stove fire resulted in damage to the building and/or

other condominium units).

The table below provides a snapshot summary of insurance coverage recommendations for investment property owners of individual condominium unit(s):

Importantly, Richey-Barrett Insurance recommends that all investment property owners who rent to tenants require the tenants purchase their own property and liability insurance coverage. Tenants who are paying insurance costs themselves tend to be responsible. Also, any loss caused by a tenant who has his/her own insurance saves you, the investment property owner, from having your insurance pay on a claim.

Richey-Barrett Insurance is your Trusted Choice Independent Insurance Agent for investment property owners. Whether your investment property is a condominium unit, single- or multi-unit dwelling, entire building, or buy-it-and-flip-it business, call us for quality insurance coverage that meets your needs.